Membership

How do I become a member?

For most, membership comes through study with us or one of our learning partners.

Our programmes include modern apprenticeships, specialist banking certificates, the flagship Advanced Diploma in Banking and Leadership in a Digital Age, and a growing range of degree programmes offered with leading universities. We also offer approved qualifications for those in regulated advice roles.

We also welcome experienced bankers who may have qualified through other bodies in the UK and overseas. Yes, there are a number of routes to membership without having a university qualification.

You do not require a university degree to undertake any Institute qualification, although other eligibility requirements may apply. Individuals become Student members upon enrolling and on successful completion attain one of our qualified membership grades.

If you have completed a qualification with another professional body you may be eligible for one of our professional conversion courses or to apply for recognition of prior learning (RPL) towards one of our standard qualifications.

If you have attained the CB:PBS Foundation standard or have completed an Institute accredited programme you can become an Affiliate member of the Chartered Banker Institute.

Do I need to become a member before I can study with the Institute?

All those studying Institute qualifications are required to hold membership of the Institute in order to begin or continue with their studies. For some qualifications we will include your initial membership fee with your module enrolment fee. Please be sure to read the relevant information on membership before you apply.

How do I find out what my membership number is?

Your membership number is listed along with your personal details, on the My Institute page of the website. It can also be found on the carrier sheet of your Chartered Banker magazine, or on your subscription renewal letter. If you cannot find your membership number, please contact [email protected].

Professional Designation when and how can I use it?

Ongoing payment of subscriptions is required to maintain eligibility to use the designatory letters or professional designation appropriate to your grade of membership. You must also satisfy any relevant CPD requirements.

We suggest that you use the following format for email signatures, business cards or other instances where you use professional designations or designatory letters. The professional designations Chartered Banker and Associate Chartered Banker should always be written in full, there is no abbreviated version (post nominal letters). Please note that this is intended to be a guide and is not a definitive list of designations.

Name, MCBI

Chartered Banker

Name, ACBI

Associate Chartered Banker

Name, PMA

or

Name

Professional Mortgage Adviser

How can I pay my membership subscription?

Your annual subscription can be paid by direct debit, by credit or debit card via the members' section of the website or by cheque. You can also pay in monthly instalments by direct debit only. If you are an existing member and would like to pay your subscription online, please click here.

My membership has lapsed, can I still access my account?

You will be able to login, but you will be unable to access any of the members only content. You will need to reinstate your membership to regain access.

How do I reinstate my membership?

To reinstate your membership, please download the below form and once complete, please return to [email protected] or the following postal address:

Chartered Banker Institute

CT, 61 Dublin Street

Edinburgh

EH3 6NL

Once received, your reinstatement will be processed within 10 working days. You will receive an email confirmation once you have been fully reinstated.

Am I eligible to claim free or reduced membership subscription concessionary rate?

As an educational charity the Institute is keen to assist both students and qualified bankers in retaining their membership and may be able to offer a reduced or free membership in the following circumstances:

- Retired members

- Redundancy or other loss of main income

- Job seeker

- Career break

- Maternity/paternity or shared parental leave

- Incapacity due to ill health

More information on the assistance available and eligibility criteria can be downloaded here.

Can I get tax relief on my membership subscription?

Liability for Income Tax is a matter for negotiation between individuals and their respective Tax Authorities. However, within the UK, current guidance from HMRC is that you can reclaim tax on fees or subscriptions you pay to some approved organisations but only if you must have membership to do your job or it’s helpful for your work. The Chartered Banker Institute is on the HMRC list of approved organisations.

Claims can be made to HMRC via a Self-Assessment tax return, online, in writing (form P87) or, in some circumstances, by phone. Further guidance and instructions on how to claim can be found at www.gov.uk/tax-relief-for-employees/professional-fees-and-subscriptions. Please note that you cannot reclaim tax on fees or subscriptions if your employer has paid for them.

If you require a receipt for your membership payment in order to claim tax relief, please contact [email protected].

If I have further questions about my membership who should I contact?

In the first instance, please email [email protected]. You can also contact our Membership Engagement Team via webchat facility, located on our website. Our standard business hours are Monday to Friday 9am-5pm UK time.

EXAMS DELIVERED BY PEARSON VUE

How do I book an exam?

All exams (UK and internationally) can be booked online via our exam provider Pearson Vue.

Booking an exam is simple – please see our step by step guide on booking here.

How do I cancel/amend my exam?

After a booking has been confirmed Students can reschedule or cancel their exam without penalty:

- 48 hours prior to the booked appointment for test centre exams

- up to the scheduled appointment time for remotely proctored exam.

Please note that if you wish to change the method of exam (remote to centre based or vice versa) then your original booking must be cancelled and re-booked.

You can amend your exam booking at any time by logging in to the My Institute pages. Simply select the exam you wish to reschedule or cancel, and you’ll be redirected to the exam booking system to make the change.

Once you’ve updated your booking, please check your email inboxto ensure you have received a confirmation email. This is the best way to be certain your changes have been finalised.

Please note: if you do not reschedule or cancel your booking in advance and the exam is recorded as a No Show, an additional exam fee will apply. This is because fees are charged for each booking, not only for exams attempted.

The only exception is where extenuating circumstances have prevented you from attending your booked exam. In such cases, please contactPearson Vue immedietly to request an emergency reschedule due to the situation.

What is/what is not allowed to be taken into the exam area?

Please see here (sitting at an exam centre) and here (sitting an exam via remote invigilation).

The rules differ depending on whether you are sitting your exam at a test centre or via remote invigilation (at home). Please read the guidance carefully and refer to your exam confirmation for full details.

Sitting an Exam at a Test Centre

-

Personal items – No personal items may be taken into the testing room. This includes bags, books not authorised by the sponsor, notes, phones, pagers, watches, and wallets.

-

Calculator – Not permitted. An embedded calculator is provided within the exam.

-

Water/Fluids – No water or other fluids may be taken into the exam room. You may request to leave the exam room to use the centre’s water machine; however, your exam timer will continue to count down while you are away.

-

Pen & Paper – Not permitted. An online scratchpad is embedded within the exam (you can familiarise yourself with this here: Pearson VUE Whiteboard Tool).

-

Toilet breaks – Permitted. Please note that your exam time will continue to count down during your absence.

Sitting an Exam via Remote Invigilation (at Home)

-

Eating/Drinking/Smoking – Beverages in any container are permitted; however, please plan accordingly as you may not receive breaks during the exam. Eating, chewing gum, smoking, or using tobacco products is not allowed at any time.

-

Calculator – Not permitted. An embedded calculator is provided within the exam.

-

Pen & Paper – Not permitted. An online scratchpad is embedded within the exam (see Pearson VUE Whiteboard Tool).

-

Toilet breaks – Not permitted. Candidates must remain in front of their computer for the entire duration of the exam.

Centre Based Exams

We ask that you arrive at the test centre 15 minutes before your scheduled appointment time. This will give you adequate time to complete the necessary sign-in procedures. If you arrive more than 15 minutes late for your appointment, you may be refused admission and the exam fees will be forfeited.

You will be required to present one form of original (no photo copies), valid (unexpired) government issued ID that includes your name, photograph, and signature. The first and last name that you used to register must match exactly the first and last name on the ID that is presented on test day. All IDs required must be issued by the country in which you are testing. If you do not have the qualifying ID issued from the country you are testing in, an International Travel Passport from your country of citizenship is required. If you have any questions or concerns about the ID you are required to bring with you to the testing center for admittance for your exam please contact Pearson VUE customer Service at here. To view the full ID policy, including any additional allowances to this policy, please visit here.

The name on the registration must match the names on the government-issued ID exactly. Please verify that your name listed on your confirmation email matches your identification. If your identification is not considered valid, you will not be permitted to complete your exam and are unlikely to receive a refund.

Examples of acceptable identification:

- Passport

- Driving licence

- Military ID (including spouse and dependents)

- Identification card (national or local)

- Registration card (such as green card, permanent resident, visa)

Remotely Proctored Exams

Please see here (sitting an exam via remote invigilation) for what to expect when you undertake a remotely proctored exam.

Before the exam:

Visit the CBI Online Proctoring page and review information on exam policies and procedures, system requirements and the System Test -

https://home.pearsonvue.com/cbi/onvue

Complete the required System Test from the same computer, in the same location and roughly the same time that you’ll be using on exam day. *Corporate firewalls often cause issues while trying to take your exam. Please consider taking your exam in a setting without a corporate firewall.

Please ensure you have a strong and stable internet connection as we are unable to guarantee a successful exam completion if this is not in place.

Review the identification requirements below

Please be prepared to show one (1) valid form of unexpired, government-issued personal ID. The government-issued ID must have your signature and must have your photo.

The name on the registration must match the names on the government-issued ID exactly. Please verify that your name listed on your confirmation email matches your identification. If your identification is not considered valid, you will not be permitted to complete your exam and are unlikely to receive a refund.

Examples of acceptable identification:

Passport

Driving licence

Military ID (including spouse and dependents)

Identification card (national or local)

Registration card (such as green card, permanent resident, visa)

Please note that we are unable to accept the following IDs for an online proctored exam.

Renewal forms with expired IDs

Government-issued name change documents with government ID

On exam day:

We recommend logging in to your account 30 minutes early to start the check-in process and to allow for any troubleshooting. If you are more than 15 minutes late after your scheduled exam time, you will be unable to begin your exam and are unlikely to receive a refund.

How do I begin my Remote Proctored exam?

The exam check in information is included in your exam booking confirmation email.

If this email is unavailable to you, or you are experiencing difficulties with the link please follow alternative instructions below:

- Log into your Member Area here

- Once logged in please select ‘Remote Proctored Exam’ from the Member Area dropdown menu

- Click on your scheduled exam under “Purchased Online Exams”.

- Click “Begin Exam” and follow the on-screen prompts to complete the check-in process.

- Once you have completed the check-in process, you will be contacted by a Proctor to begin your exam.

How / When do I receive my results?

Multiple choice results will be displayed immediately upon completion of the exam. You can also access your detailed Score Report from My Members Area drop down menu and select ‘View Score Report’

Results for written exams and assignments are normally available no later than six weeks following your exam date these are also available via your My Member area.

Can I re-sit if I need to?

Yes. In the event that you fail an exam, you are welcome to book a re-sit. Please allow up to 48 hours from your first exam sitting before booking an exam resit . We recommend that you do allow adequate study and revision time to ensure you are well-prepared for your re-sit. Please note that a re-sit fee may apply, the cost of which will vary depending on the qualification.

When will I receive my certificate?

The Chartered Banker Institute transitioned to digital certificates for all qualifications, allowing for faster processing and support of our sustainability initiatives. From 13 February 2023, you will receive your digital certificate via email, usually within 5 business days of successfully completing your qualification. If you don't see your certificate in your inbox, please check your junk email folder.

For a list of qualifications receiving digital certificates, please check this link. You can print your digital certificate on paper of your choice at your own expense. However, if you prefer a paper certificate, you can request one for a fee by emailing our Member Engagement Team here. The digital certificates are easy to share directly via social media or email. For any questions or concerns, please contact us at [email protected].

Routes to Chartered Banker

I’d like to study for a professional banking qualification, what are my options?

Brief summary of range of qualifications. Link to more info.

Can I obtain a professional designation without completing an Institute qualification?

In addition to the Advanced Diploma in Leadership and Banking in a Digital Age, there are several other routes to Chartered Banker status.

A number of the UK’s world class universities are offering banking related postgraduate programmes that meet the requirements to become a qualified member of the Institute. This includes the Chartered Banker MBA offered by Bangor University Business School.

The Institute also offers a professional conversion route for individuals who are Certified Associates of the Indian Institute of Bankers (CAIIB)

Professional conversion programmes do require some further study but are shorter than undertaking the full Diploma.

Can I become a qualified member by studying at a university?

The Chartered Banker Institute works with a number of University Partners, including our Centres of Excellence, and have formally accredited programmes, giving those successfully completing the degrees the option to apply for full Chartered Banker Status or Associate Chartered Banker status. More information can be found here.

I already have a degree or other qualification, can I get any recognition for this?

The Chartered Banker Institute also recognises that knowledge and skills can be attained from a broad range of learning. The Institute is therefore committed to ensuring that, where appropriate, knowledge and skills which are gained via the certificated programmes of other recognised awarding bodies can be given credit towards its own professional qualification programmes. For more information please visit our Recognition of Prior Learning (RPL) page.

I already have a professional qualification, can I become a member?

The Chartered Banker Institute currently offers an IIBF Professional Conversion Programme route to Chartered Banker status for individuals who are Certified Associates of the Indian Institute of Bankers (CAIIB). More information on this programme can be found on our qualifications pages.

The Chartered Banker Institute also recognises that knowledge and skills can be attained from a broad range of learning. The Institute is therefore committed to ensuring that, where appropriate, knowledge and skills which are gained via the certificated programmes of other recognised awarding bodies can be given credit towards its own professional qualification programmes. For more information please visit our Recognition of Prior Learning (RPL) page.

I’ve achieved one of the Chartered Banker Professional Standards. Can I become a member?

Individuals who have attained the CB:PSB Foundation Standard are eligible to become Affiliate members of the Chartered Banker Institute.

The CB:PSB has developed routes to qualified professional membership from the Foundation, Intermediate and Advanced Standards. For more information please email our Member Engagement Team: [email protected]

How can I become a Fellow of the Institute?

To be eligible for Fellowship of the Institute, all candidates should be experienced banking practitioners and must have ten years' experience in banking.

Candidates must hold or attain Chartered Banker status and have made a significant contribution to the work of the Institute and the banking profession. They must also demonstrate an ongoing commitment to continuing professional development and act as a role model and mentor to others in the profession.

Attaining Chartered Banker status requires completion of an advanced professional qualification recognised by the Institute, which includes study of professionalism and ethics, and appropriate coverage of credit and lending. Click here for more information and details of how to apply.

Can I become a member by completing an apprenticeship?

The Institute’s qualifications underpin a range of banking and financial services Apprenticeship programmes, which are also aligned to our membership grades.

If you undertake an Apprenticeship programme that utilises Institute qualifications you will become a Student member and, upon successful completion, may become a qualified member of the Institute. Our qualifications offer a clear progression route that will enable you to progress to further professional or postgraduate qualifications and, potentially, to attain full Chartered Banker status.

Can I become a member without having a university qualification?

If you have attained the CB:PSB Foundation Standard or have completed a programme of study accredited by the Institute you can become an Affiliate member.

You do not require a university degree to enrol for any Institute qualification, although other eligibility requirements may apply. Individuals become Student members upon enrolment and, on successful completion attain one of our qualified membership grades.

If you have completed a qualification with another professional body you may be eligible for one of our professional conversion courses or to apply for credit towards a standard qualification through recognition of prior learning (RPL).

CPD

What is Continuing Professional Development (CPD)?

"Continuing professional development (CPD) is the means by which members of professional associations maintain, improve and broaden their knowledge and skills and develop the personal qualities required in their professional lives.” PARN (Professional Associations Research Network).

What are the Chartered Banker Institute's CPD requirements?

CPD can take many different forms and varies for each individual; every development plan is as unique as a fingerprint. We've therefore designed our CPD scheme to reflect the many different career paths in banking.

You can find out more from our CPD guide here.

Qualifications

Can I apply at any time of the year to study with the Institute?

Absolutely! We run our programmes all year round, meaning you can apply at any time of the year for any module or qualification. Some of our partner programmes, such as the Chartered Banker MBA may, however, have specific registration periods, although they are happy to note your interest at any time. Please check with them for details before applying.

How do I apply for a qualification?

If you are paying via credit or debit card, you can apply for qualifications via our website. If your employer would like to be invoiced for the qualification, please ask that they send a purchase order to [email protected].

What happens after I apply for study with the Institute?

Your application is reviewed and processed. Once everything has been approved, you will be sent the welcome email with further instructions. This should take a maximum of 5 working days.

When do I receive study materials?

With the exception of certain modules1, all students will have access to a digital version of the workbook. Learning is delivered online via the Institute’s Learning Management System or supplied as a PDF version of the comprehensive workbook.

1 Students studying modules listed under Advanced Diploma in Banking and Leadership in a Digital Age and Team Leadership module can choose to have either online e-book supplied via Vital Source portal OR hard copy of the book ordered via Amazon with voucher code provided.

English is not my first language, can I still study with you?

Absolutely! However, as our programmes and assessments are in English, it helps to have a good standard of English before studying with us. We would recommend that you have at least one of the following:

- IELTS: minimum grade 6-6.5

- TOEFL: minimum 550 paper-based / 213 computer-based

- GCSE: Minimum grade C

- Cambridge certificate of proficiency in English: minimum grade C.

- Cambridge English Scale: Advanced & Proficiency - a score of 176 with no less than 162 in each component.

- Evidence of having sat previous examinations in English will also be acceptable.

How long do I have to complete the qualification?

Registration is valid for 12 months. Learners are expected to sit and pass the examination within that time.

Can I pay for my studies in instalments?

As with all of our student members, all Institute fees must be paid before you are registered onto our programmes. You should therefore wait for confirmation from us that you have met the entry criteria and have been accepted onto the programme before making final payment. Please note that some of our partners may operate different arrangements and will advise you when you apply.

Do qualifications count towards CPD?

Yes. See My CPD for more examples.

Learning Management System (LMS)

How to access the Learning Management System (LMS)

Your learning materials are delivered via the Institute's Learning Management System (LMS). This system will give you access to your online resources which includes a variety of case studies, e-learning modules, audio and visual resources, as well as some online quizzes to consolidate your learning.

The LMS system also gives you access to online knowledge checks to enhance your understanding of key concepts, a list of questions to aid your exam preparation, and additional personal reflection tools to support the application of learning at work.

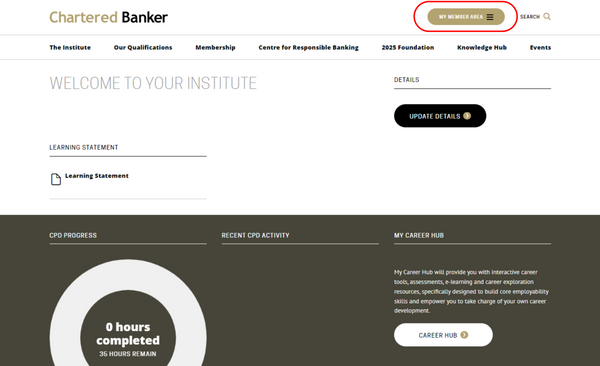

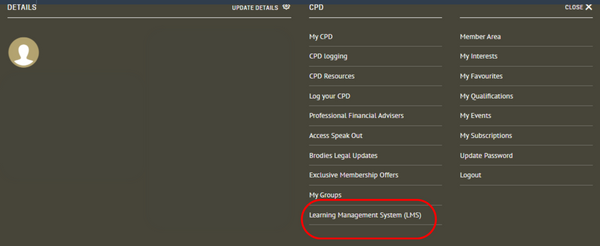

To access the LMS please:

- Visit our website www.charteredbanker.com.

- Log in to your personal My Member Area home page.

- Click on the Learning Management System (LMS) link.

1.

2.

3.

Upcoming Changes to Learning Management System (LMS) – Effective 30 September 2025

From 30 September 2025 Learning Management System (LMS) will have a refreshed look and feel.

-

You will continue to log in using your existing login details – no changes are required.

-

All your current courses and completed training remain unaffected.

-

Navigation has been simplified, giving you quicker and clearer access to your course activities and progress.

To help you get familiar with the new look, we’ve attached a short user guide to this FAQ highlighting the main changes.

Events

Can I attend Institute member events if i'm not a member?

Yes, the majority of our online events we run are free to attend for everyone. If this is not the case it will be stated on the booking details tab of the event you are looking at.

Can I book online on behalf of another person?

Yes if booking via zoom you can input the person’s details you are booking for. Make sure to use their email and not your own so that they get the invite.

How can I find out about all the upcoming events?

Visit our events section of our website here to view all of our upcoming events.

International

What entry requirements do you have for international students?

All of the same entry requirements apply for international students as with UK students.

English is not my first language, can I still study with you?

Absolutely! However, as our programmes and assessments are in English, it helps to have a good standard of English before studying with us. We would recommend that you have at least one of the following:

- IELTS: minimum grade 6-6.5

- TOEFL: minimum 550 paper-based / 213 computer-based

- GCSE: Minimum grade C

- Cambridge certificate of proficiency in English: minimum grade C.

- Cambridge English Scale: Advanced & Proficiency - a score of 176 with no less than 162 in each component.

- Evidence of having sat previous examinations in English will also be acceptable.

Does evidence of my qualifications need to be verified before I apply?

If you already hold one or more qualifications in banking/finance, please submit an application for Recognition of Prior Learning. This may entitle you to exemptions, lowering the number of modules required to obtain certain qualifications. You can submit your application here.

Are there international exam centres?

We have partnered with Pearson VUE for the delivery of our exams internationally. Members can take their exams in a variety of locations and there is also the opportunity to take exams via remote proctoring. To book your exam, please login to the member area of the website. There you can choose to take your exam in one of Pearson VUE's exam centres or via remote proctoring

Are there set exam dates for international students?

You do not need to sit your exam on a set date. You will be offered a range of date options to choose from.

Are there any special rules applying to international students?

As all of our qualifications are distance learning-based, they can be studied from anywhere in the world. There is almost no difference in studying overseas versus studying in the UK. Depending on the qualification you choose to enrol for, you may be charged additional postage if you wish to receive hard copies of the study materials.