With nearly 150 years of experience in educating bankers and with a network in excess of 35,000 professional bankers around the globe, our Institute is proud to be regarded as a leading voice in responsible banking. We believe that a responsible banker is someone who possesses a clear understanding of the ethically sound course of action, paying due regard to the interests of the customer (and community), treating them fairly, and acting with respect and integrity.

At the Institute we ensure this core theme of responsible banking is embedded in our qualifications, professional learning, thought leadership and membership offerings. This supports all professional bankers, including those who have earned Chartered Banker status, to continue to develop the skills needed to shape a sustainable and responsible future for banking.

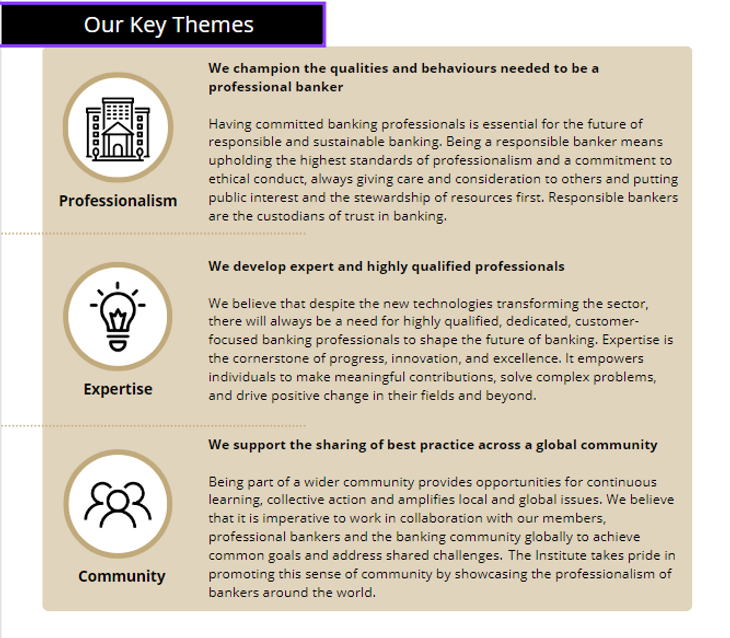

We have three key thematic strands, which are used to develop the Institute’s thought leadership and these four themes all fall under the umbrella of our key theme, which is Responsible Banker: Professionalism, Expertise, and Community.

Responsible banking and sustainable finance has broad and far-reaching implications to global society and to the banking and finance sector. Banks and individual bankers are major drivers in supporting and facilitating change to a greener, fairer and more sustainable future, by their support of customers, communities and society through responsible lending and inclusive, customer-centric services. In supporting and facilitating increased change towards socially purposeful finance, banks and bankers must also balance the impact and timing of their activities and decisions in the short, medium and long-term and also consider how change can provide a socially just transition for all stakeholders.

The institute recognises the challenging and fundamentally far-reaching nature of a responsible, sustainable approach to banking and seeks to follow and align with the UN Principles for Responsible Banking. We treat the Principles as a cornerstone when developing a range of content for our educational programmes.

The Principles provide a framework for positive change in banking and finance. But change is led, ultimately, by confident, well informed and professional individuals leading their organisations. The change we seek in mainstreaming responsible, sustainable finance in general, and the Principles for Responsible Banking in particular, needs to be led by increasing numbers of committed banking finance professionals.

- Professionals with an understanding of the critical role of financial services in supporting the transition to a low-carbon world are needed – as set out in the Paris Agreement.

- Professionals who understand how socially purposeful, customer-focused banking creates value for society, as well as for shareholders.

- Professionals with the knowledge and skills to be able to develop and deploy strategies, products, services and tools in their institutions that will embed the Principles for Responsible Banking.

- Developing the knowledge and skills of such individuals to support responsible, sustainable banking is what we do at the Chartered Banker Institute.